The EUR/AUD perspective is bearish, as commodity currencies like the Australian Dollar gain from the latest global economic growth after the recession triggered by the coronavirus pandemic. Many raw materials, such as iron ore, coal, and aluminium, are produced in Australia, which could boost the AUD against currencies such as the EUR, CHF, and JPY as economic growth picks up.

Commodity currencies like the Australian dollar are well Positioned to advance, as the global economy is having expansion from the Devastating effects of the covid-19 pandemic. Inspite of having all signs of a Recovery the outlook for EUR/AUD in particular is downtrend, as the pair has Been strengthening since late february.

On february 25, The EUR/AUD fell to a new low of 1.5253, just above 1.55. Although trendline support is currently showing at 1.5360, It would not be surprising if that level is challenged and ultimately broken.

Figure 1: EUR/AUD PRICE CHART, DAILY TIMEFRAME (OCTOBER 1, 2020 – MAY 5, 2021)

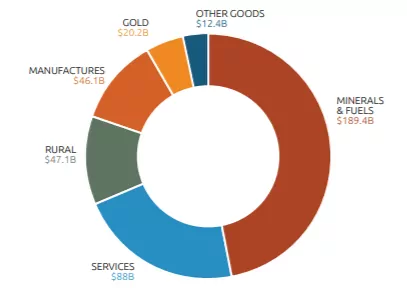

Australia is a big producer of raw materials like iron ore, copper, and aluminium, all of these should be in high demand as the economy recovers from the downturn. According to the most recent results, minerals and fuels accounted for 47 percent of total exports.

Figure 2: Australian Department of Foreign Affairs and Trade (data in A$)

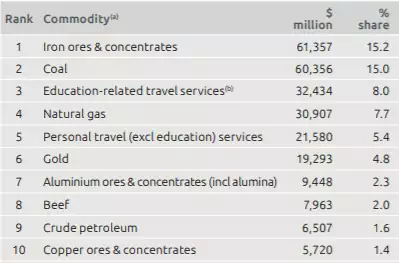

Figure 3: DFAT (data in A$)

For example, the price of iron ore has risen by 94% in the last 15 months, hitting new highs as supply has been unable to keep up with demand from China, where steel production has increased by 30% in the last five years.

Figure 4: Iron Ore Price Chart, Daily Timeframe

Copper's price had more than doubled since its low in March 2020, so shockingly, the Australian Dollar hasn't appreciated much more. Consequently, a drop in the EUR/AUD is anticipated, triggering this bearish call on the cross and, by extension, strength in commodity currencies such as the CAD and NZD.